Jet Fuel Price Hedging . airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of 2024, for $129.87 and $123.80 per. One simple strategy is to buy.

from aegis-hedging.com

airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. One simple strategy is to buy. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of 2024, for $129.87 and $123.80 per. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of.

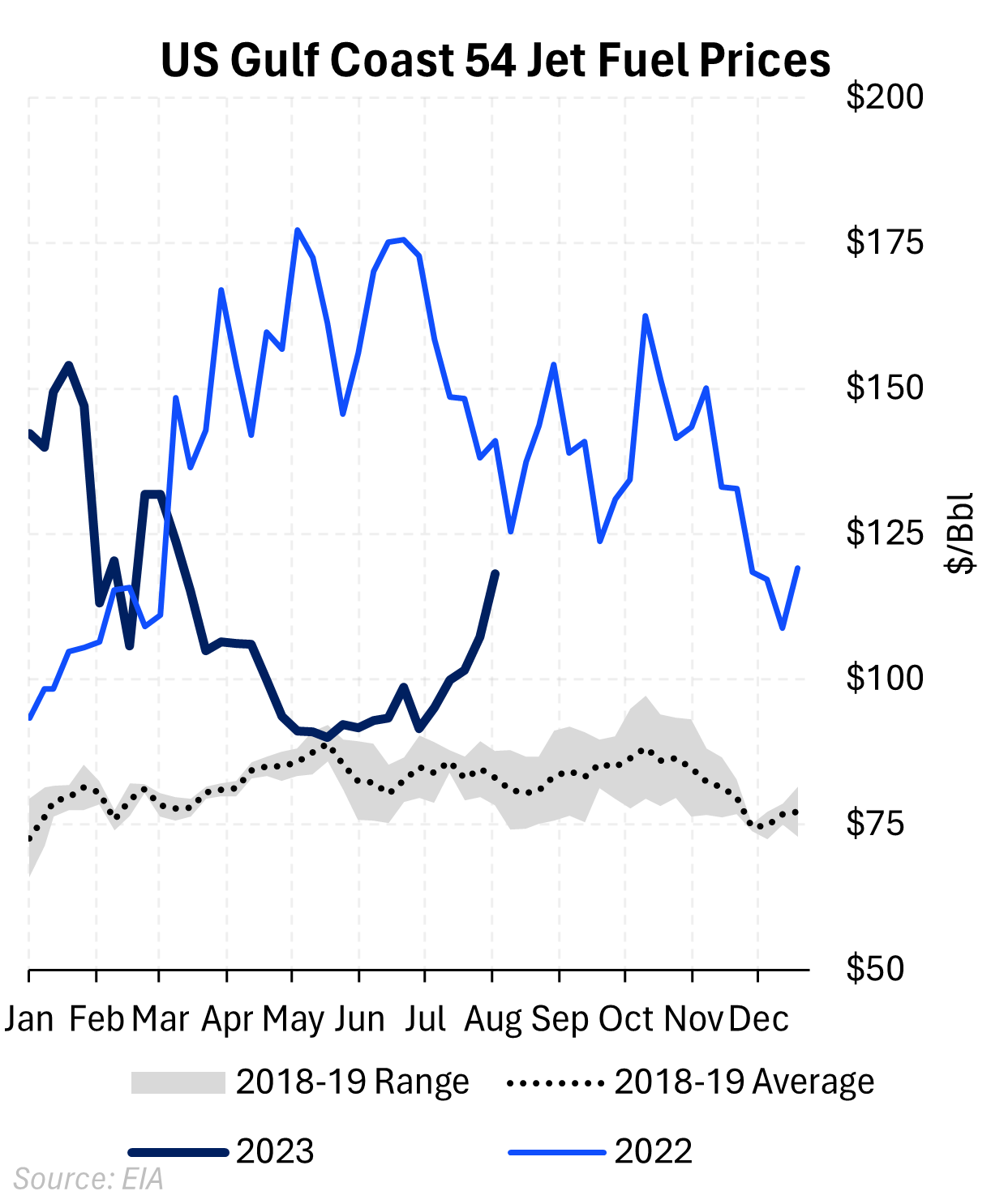

Rising Jet Fuel Prices A Challenge to the Aviation Industry's Recovery

Jet Fuel Price Hedging One simple strategy is to buy. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of 2024, for $129.87 and $123.80 per. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. One simple strategy is to buy. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices.

From aegis-hedging.com

Jet Prices Lifted By Oil and Refining Bullishness Aegis Market Insights Jet Fuel Price Hedging the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. One simple strategy is to buy. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. fuel hedging is a financial strategy airlines. Jet Fuel Price Hedging.

From www.researchgate.net

(PDF) Airline Jet Fuel Hedging Theory and Practice Jet Fuel Price Hedging the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. fuel hedging is a financial strategy airlines employ to safeguard against volatile and. Jet Fuel Price Hedging.

From simpleflying.com

What is Fuel Hedging and Why Do Airlines Do It? Simple Flying Jet Fuel Price Hedging fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first. Jet Fuel Price Hedging.

From www.researchgate.net

(PDF) Analysis of the Jet Fuel Price Risk Exposure and Optimal Hedging Jet Fuel Price Hedging One simple strategy is to buy. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of 2024, for $129.87 and $123.80 per. airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. the group has hedged 70% of its. Jet Fuel Price Hedging.

From dxosaotkx.blob.core.windows.net

Jet Fuel Prices Australia at Dorothy Reynolds blog Jet Fuel Price Hedging The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first. Jet Fuel Price Hedging.

From www.linkedin.com

IndiGo avoids jet fuel hedging Jet Fuel Price Hedging airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. One simple strategy is to buy. fuel hedging is a financial strategy airlines employ to safeguard against volatile and. Jet Fuel Price Hedging.

From www.researchgate.net

(PDF) Analysis of the Jet Fuel Price Risk Exposure and Optimal Hedging Jet Fuel Price Hedging the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in. Jet Fuel Price Hedging.

From www.mdpi.com

Commodities Free FullText Jet Fuel Price Risk and Proxy Hedging in Jet Fuel Price Hedging the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of 2024, for $129.87 and $123.80 per. One simple strategy is to buy. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. fuel. Jet Fuel Price Hedging.

From www.mdpi.com

Commodities Free FullText Jet Fuel Price Risk and Proxy Hedging in Jet Fuel Price Hedging airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. One simple strategy is to buy. The price of crude oil and jet fuel steadily increased over the course of 2021 and. Jet Fuel Price Hedging.

From www.casehero.com

2012 Fuel Hedging at JetBlue Airways Case Solution Jet Fuel Price Hedging fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. airlines can employ several hedging strategies to protect their bottom lines from fluctuating. Jet Fuel Price Hedging.

From www.researchgate.net

(PDF) Jet Fuel Hedging and Modern Financial Theory in the U.S. Airline Jet Fuel Price Hedging airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. One simple strategy is to buy. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. The price of crude oil and jet fuel steadily increased over the course of. Jet Fuel Price Hedging.

From www.mercatusenergy.com

Jet Fuel Hedging, Marketing, Supply & Trading Jet Fuel Price Hedging the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. One simple strategy is to buy. airlines can employ several hedging strategies to. Jet Fuel Price Hedging.

From www.slideserve.com

PPT Jet Fuel Hedging PowerPoint Presentation, free download ID4731331 Jet Fuel Price Hedging The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of.. Jet Fuel Price Hedging.

From airspace-africa.com

Jet Fuel Prices now Trending Downward IATA Airspace Africa Jet Fuel Price Hedging One simple strategy is to buy. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. The price of crude oil and jet fuel. Jet Fuel Price Hedging.

From www.slideserve.com

PPT Global Airlines PowerPoint Presentation, free download ID206940 Jet Fuel Price Hedging One simple strategy is to buy. The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. fuel hedging is a financial strategy airlines. Jet Fuel Price Hedging.

From aegis-hedging.com

Rising Jet Fuel Prices A Challenge to the Aviation Industry's Recovery Jet Fuel Price Hedging One simple strategy is to buy. the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. The price of crude oil and jet fuel. Jet Fuel Price Hedging.

From www.mdpi.com

Commodities Free FullText Jet Fuel Price Risk and Proxy Hedging in Jet Fuel Price Hedging airlines can employ several hedging strategies to protect their bottom lines from fluctuating oil prices. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. One simple strategy is to buy. the group has hedged 70% of its jet fuel consumption for the fourth quarter of. Jet Fuel Price Hedging.

From www.cmegroup.com

Global Jet Fuel Price Decline Stimulates Increased Hedging Activity Jet Fuel Price Hedging the group has hedged 70% of its jet fuel consumption for the fourth quarter of 2023 and 64% for the first quarter of 2024, for $129.87 and $123.80 per. fuel hedging is a financial strategy airlines employ to safeguard against volatile and fluctuating jet fuel prices, especially in times of. airlines can employ several hedging strategies to. Jet Fuel Price Hedging.